Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

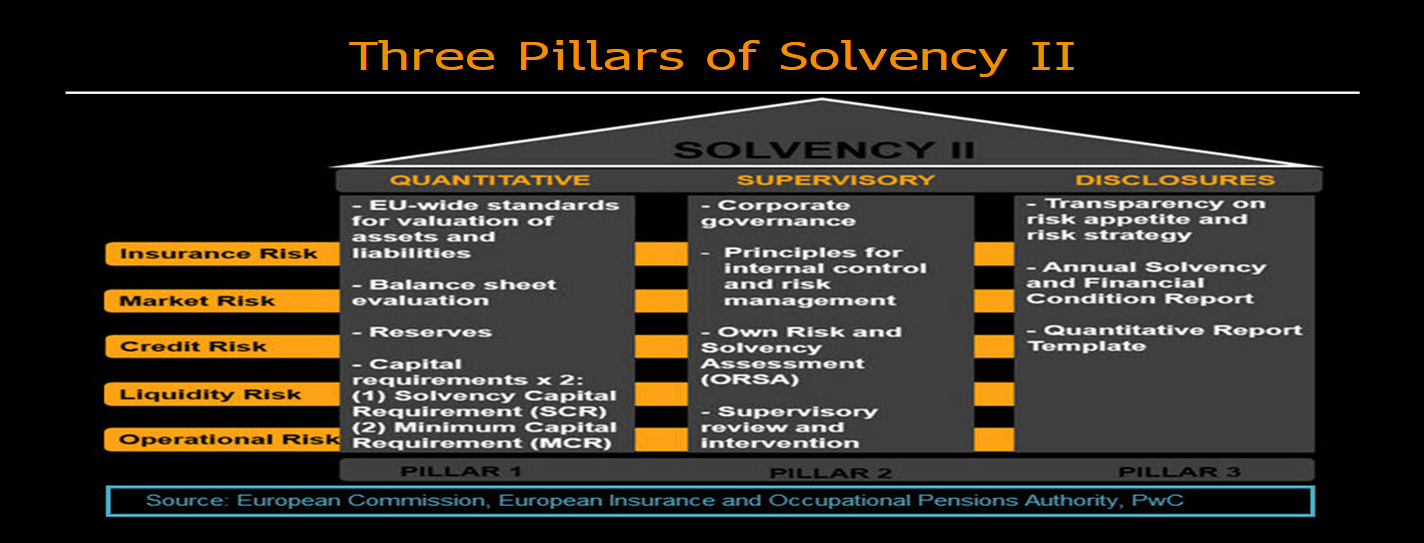

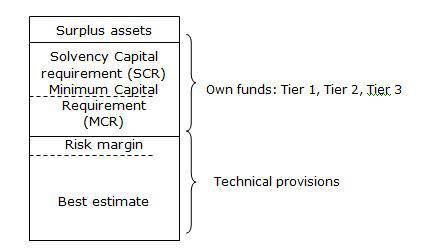

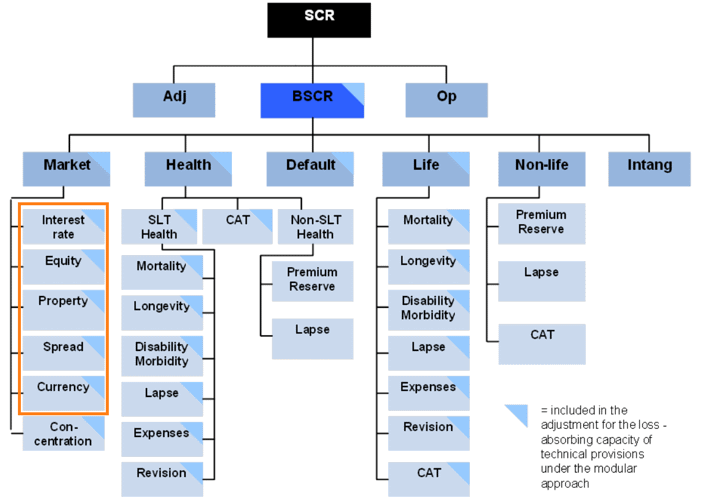

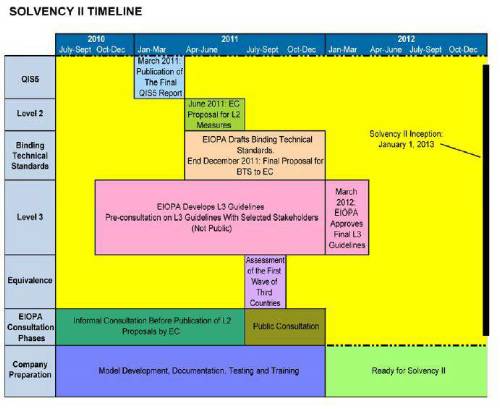

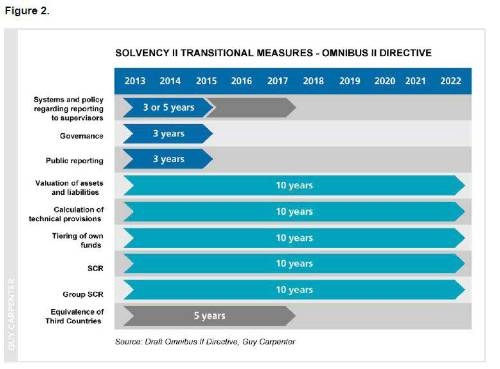

Insurance mathematics III. lecture Solvency II – introduction Solvency II is a new regime which changes fundamentally the insurers (and reinsurers). The. - ppt download

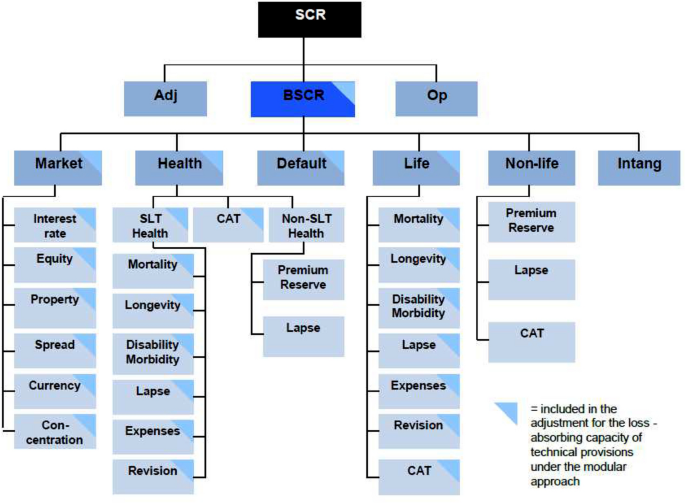

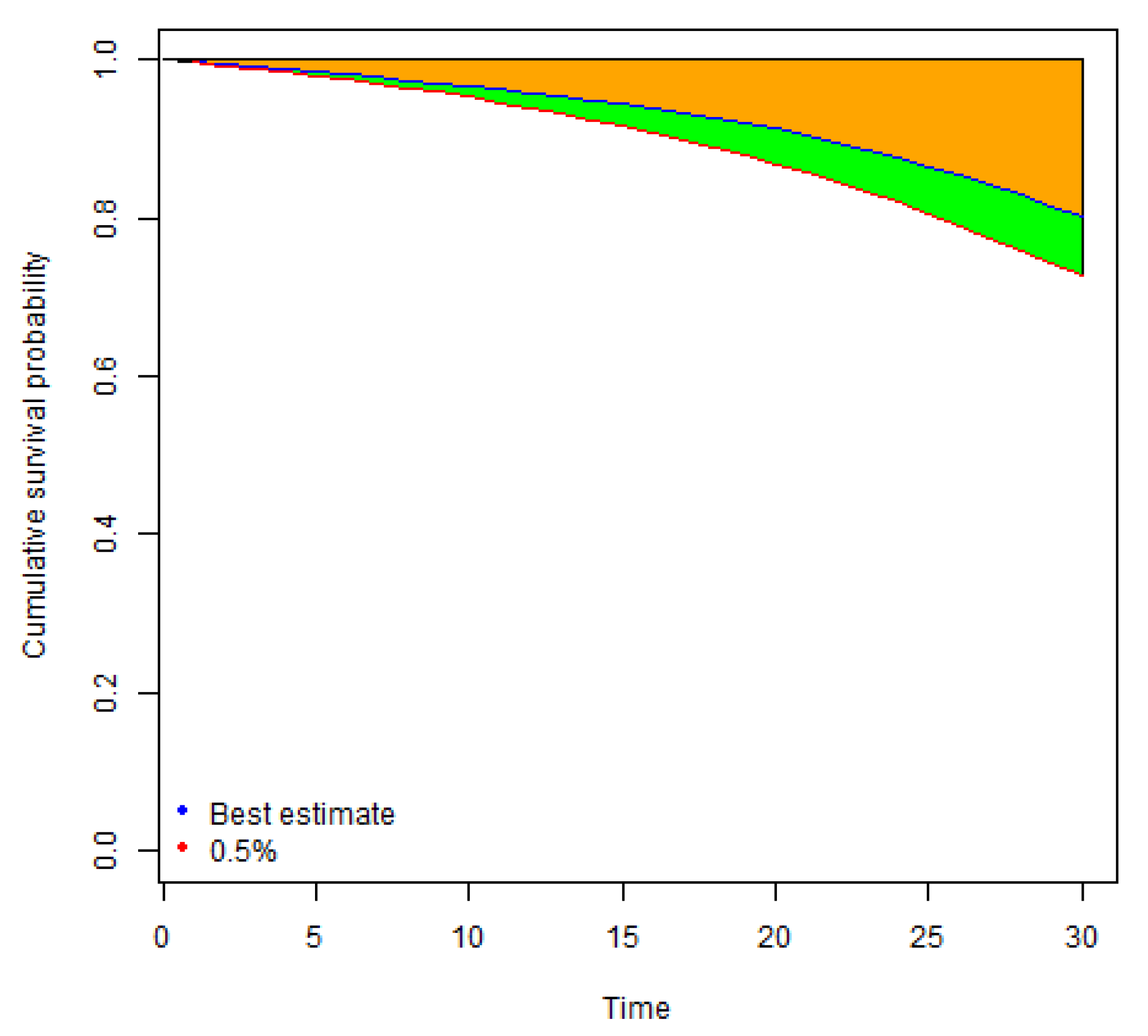

Risks | Free Full-Text | Revisiting Calibration of the Solvency II Standard Formula for Mortality Risk: Does the Standard Stress Scenario Provide an Adequate Approximation of Value-at-Risk?

3. Life underwriting risk | The underlying assumptions in the standard formula for the Solvency Capital Requirement calculation (EIOPA-14-322) | Better Regulation

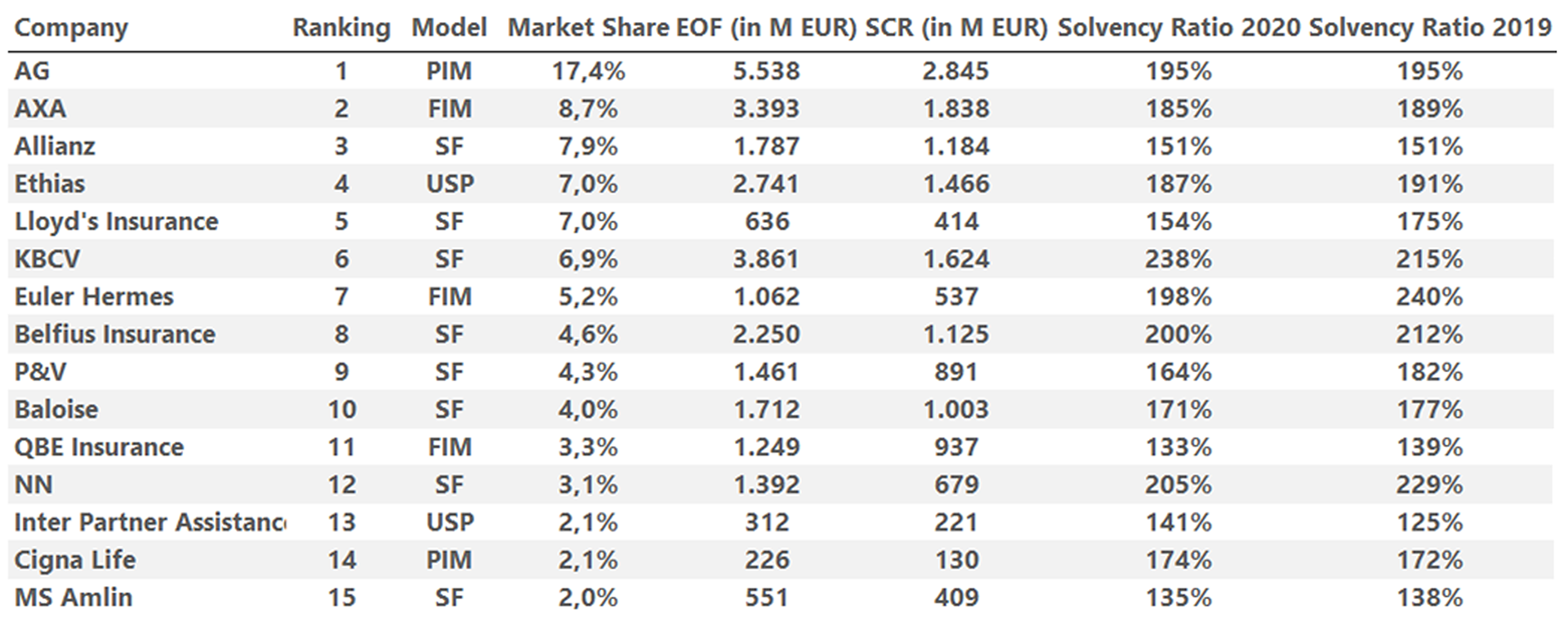

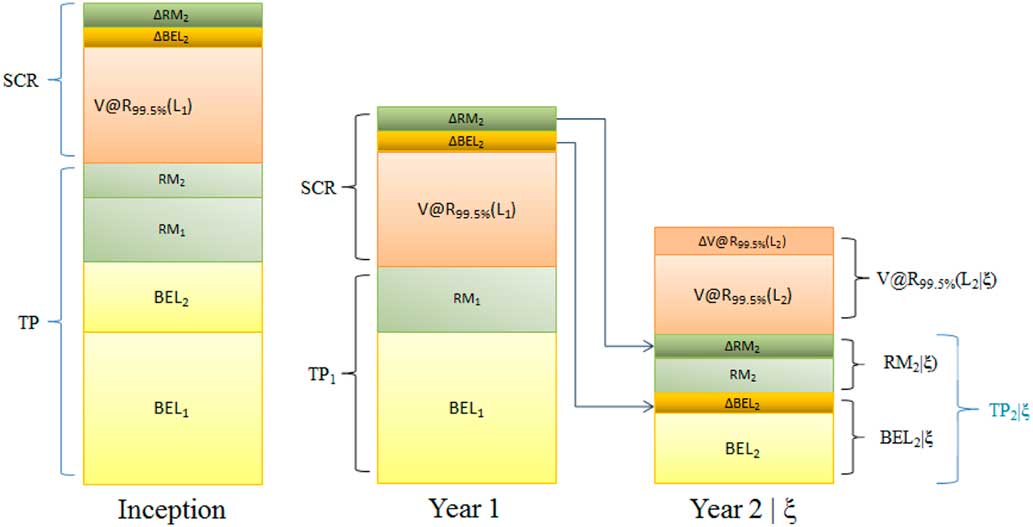

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar